Those who cannot remember the past are condemned to repeat it”…. George Santayana

Of late I have received several frantic calls from worrisome investors with regards to where the stock markets are heading. They have been perplexed by the fact that the broad market index continues to remain resilient while the performance of their own portfolio is slumbering. So how do we gauge the current scenario and what next to do?

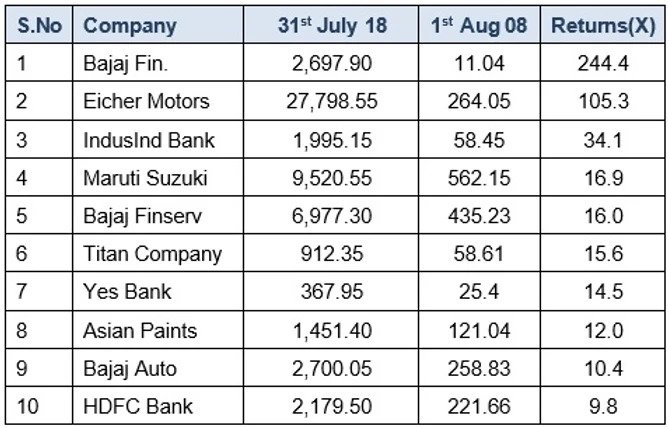

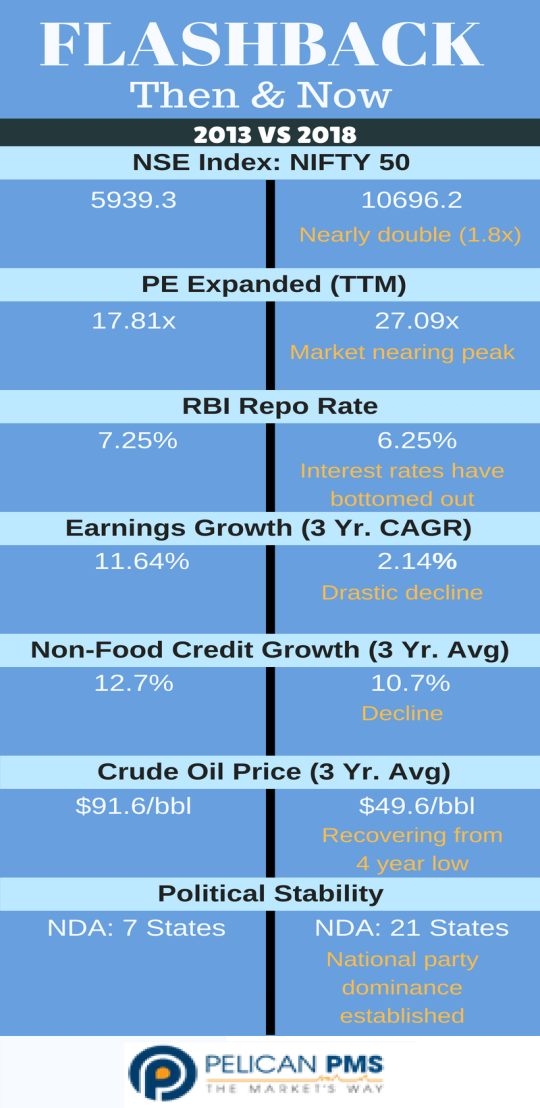

To understand the current scenario we will need to go a few years back to 2013 when the Nifty index had hit a bottom just before the ascent of the NDA government. Crude prices tanked soon after the elections in 2014 and stayed there for an unprecedented period, interest rates declined sharply and remained low for nearly four years. Earnings momentum and credit growth were in double digits. Political scenario was stabilizing. Nifty traded at 17X PE…

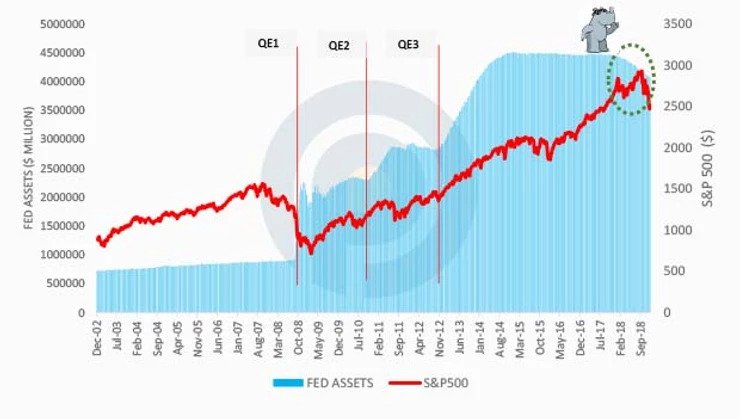

The scenario is quite opposite today. Markets are trading at an all-time high. The index has doubled over the last six years and valuations have bloated to reach the upper end of the trading band (c27x). Interest rates are inching higher and faster. Crude price is no longer benevolent and local fuel prices have already touched record highs. Inflation is rising, corporate earnings is declining and national elections are soon approaching….in short it’s déjà vu for most money managers!

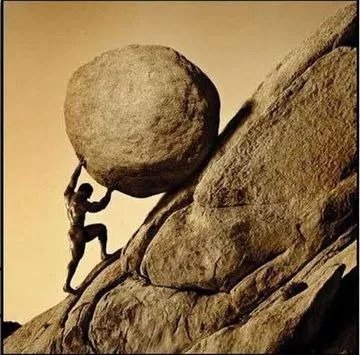

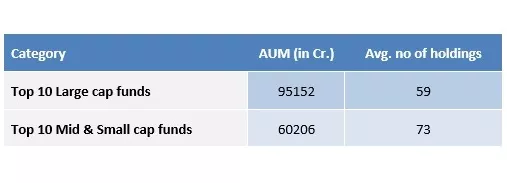

The double digit earnings growth prevalent in 2013 has currently slumped to low single digits now. We have a situation wherein prices have moved higher incoherent with the earnings growth (PE expansion-bubble). Market forces generally adjust to bring valuations to a more rational level. This adjustment has already begun. The broad market Nifty 50 index is almost flat this year with a YTD return of 2.2%, while the Mid-cap 50 index is down over 12% and the Small cap 50 index is significantly lower at 24%. Despite this decline in Mid and Small cap indices they still trade at an exorbitant valuation of 53x and 131x respectively. Still a long way to go!

The easy solution. If you think you will get a nervous breakdown and you are incapable of handling the current volatility… then just GET OUT… and come back at a better time (something we strongly recommend). Park your funds in short term money market instruments and gradually re-enter at lower levels. This may sound simple, but to implement and stay put till the clouds clear will require a strong temperament.

Alternatively, stick to the basics, which means…rinse and repeat the old gyan…

Alternatively, stick to the basics, which means…rinse and repeat the old gyan…

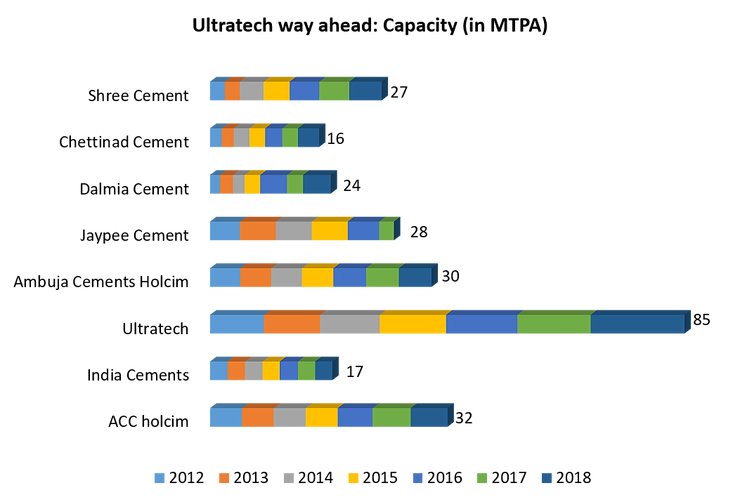

Invest in well-known Goodies: Look for companies that are low leveraged, stable growth, robust management, market leaders and large cap. Such companies will always find buyers and they will come out better from any recession. Exit companies that have uncertain volatile and complicated earnings model.

Sell high buy low- follow the PE, understand market cycles: If you believe that we are at a tipping point (which could be true) then investors who stay put now should be clear about their time horizon and look only for the long haul.

Acknowledge risk of Research failure – There are no futurists. Fund Managers, analysts are just creative human beings and they can go wrong (multiple times!) especially at market peaks.

Focus on capital preservation: Don’t feel shy of holding cash and to receive subpar returns. It will only enable you to enter at a better level and outperform later.

Finally, control emotions: don’t watch the commentary on TV, just read the news

Over the last 5 years or so, investing has seemed to be an easy business with sentiments upbeat, few disruptions, low volatility and an overall risk averse attitude. Going forward irrespective of whether you expect the market to move higher or lower, one thing is for sure, the environment has changed and the ride is going to be bumpy.