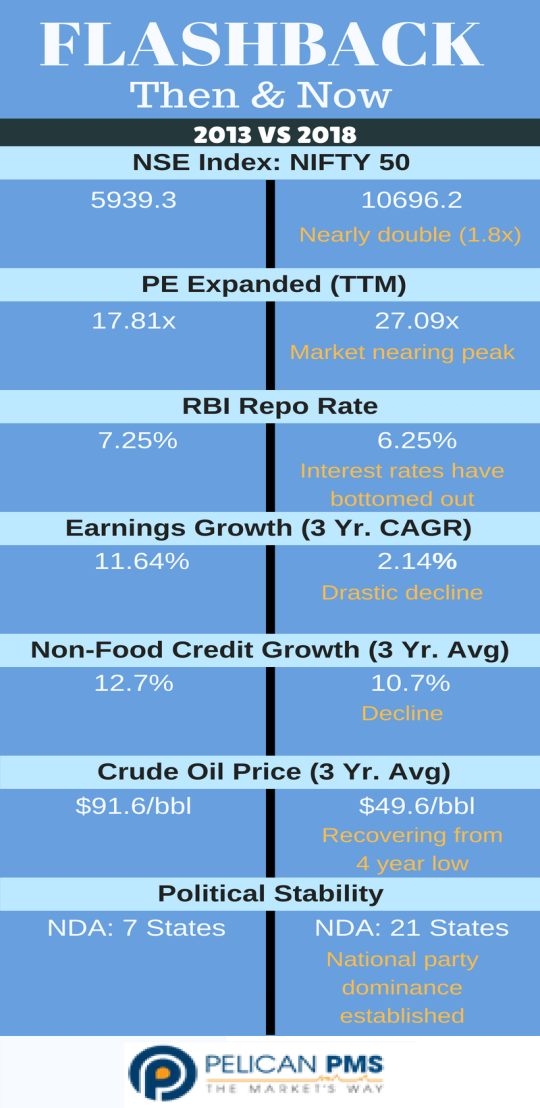

When you right click hysteria, you get both “panic” and “frenzy” as options. An apt word to define extreme stock market conditions which witness periods of melancholy followed by hubris. Both are extreme situations and opportunities to either buy or sell. Several indicators have been devised by researchers over the past to gauge such scenarios.

While some of these indicators are complicated and require heavy data crunching, there are others that are phenomenally hilarious and supposedly have a decent level of accuracy such as the – Underwear Index, Garbage indicator and R-word index. The search for a clinical definition of hysteria takes us to anxiety disorder. The anxiety here is caused due to either missing out on the upside or holding in excess during the downside. Over-dose of media and cacophony of the neighbours/friends add to this anxiety.

Alongside the usual suspects the height of hysteria is raised as we keep hearing the cliché “this time it is different”. It may not be very different despite the – never seen before pandemic driven market collapse and bounce back or the unprecedented support of liquidity. These things have happened in the past, with the only variation in degree and character. Nevertheless, this time it’s different for the presence of the following elements…zero commission brokers, social media influence and crypto. The presence of these new elements has drawn in even the most stable of minds.

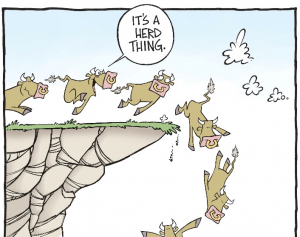

Thanks to the likes of zero commission brokers, a group which stormed into the broker lobby couple of years ago with a deal that many couldn’t refuse. It provoked even the uninitiated to give it a try- its free after all! Never in the past have we seen full page/front page ads of stockbrokers screaming at you…. ARE YOU NOT IN YET, LOSER! The target crowd are no longer people suffering a mid-life crisis, rather the young and bold (read novice and looking to make quick money). Focus is on the convenience of execution of a trade or account opening rather than on research and quality of investment. The cool dudes are the ones that appear tech savvy and make money by trading every day. Coincidently for them the markets have gone only one way and their bets have generally been correct. This has created a frenzy of sorts amongst the retail community and certainly FOMO (fear of missing out). SEBI/RBI/Finance Ministry have voiced their concern regarding the rampant increase in demat accounts- to cool off!

Bollywood endorsed crypto exchanges have gone one step further claiming safety of your funds (often misread by the gullible as capital protection). They have been sponsoring big events like IPL and constantly appear on print media as well. While there are many unknowns regarding this segment of so-called currency there is a common understanding of the knowns. This segment is unregulated, these don’t fall under the conventional definition of currency either because it is neither a store of value, medium of exchange or unit of account. Expectation of any future value emerging is speculative and can cause extreme volatility (>>small caps) or face government restrictions (as in China). Certainly not recommended for the weak hearted or retail as it entails both market risk as well as process risk.

Social media are full of advisors (influencers) giving trading tips/strategies upping their views with a loyal set of followers. Showcasing their follower base, they generally follow up with training programs mostly related to F&O trading and technical analysis. It rains money for such trainers especially when markets move like they do now. Exhibiting extraordinary past performance is an easy way to lure the naïve. Sooner than later these followers realise that trading has caused more pain than gain. Majority of these advisors are not qualified or vetted by SEBI and act outside their purview. Thanks to online training these things can be easily disguised. The explosion of social media on mobile has drawn in many with easy looking steps to profit, with available past data, without guidance on how much from savings a person may allocate to this activity while learning.

Sustainable wealth creation through a rational, tried, and tested process requires patience. The procedure of gaining quick money will only increase your risk levels. Equipment is not a major concern, let’s be clear, the app you use will not help you create wealth. Brokerage is a very small component in the big picture so zero brokers or commission brokers should not really matter. Their track record of governance will be more important. Jumping into un-tested waters like cryptos, however tempting it may appear, should not be without life jackets. Simple rudimentary products/instruments work better than complicated ones. Take a deep breath and a step back, this is a time to fine tune your investment objective and prepare a proper plan which should be supported by the strength of your temperament. Don’t fall prey to the hysteria around!