Ever since David won over Goliath, it has always been mesmerizing to watch the small guys win over the big ones. In the stock market parlance as well, we tend to enjoy stories relating to how visionary investors jumped into companies when they were small. How they envisioned its growth and how they stayed with it all the while to watch it transform into a mid-cap and now exiting when it is the much sought-after Large cap. The investor (mostly your neighbor!) has reaped in a windfall gain and lived to tell an envious story.

But the reality sucks… three out of four small cap companies have remained small since their inception over 20 years ago. Picking a small cap which will become a winner tomorrow is more like playing roulette than anything else….

The chief losses to investors come from the purchase of low-quality securities at times of favorable business conditions. “- Benjamin Graham

Performance

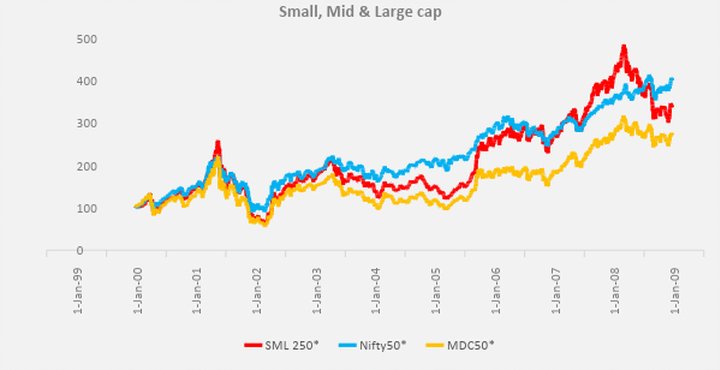

Any investment should be gauged primarily on the basis of its risk adjusted performance. The simplest and most ideal measure for risk adjusted performance is the Sharpe ratio. The Sharpe ratio provides the returns per unit of risk (volatility ~standard deviation). Higher the ratio the better. We consider the Small, Mid and Large cap indices to prove the point….

Evidently, both in terms of absolute as well as on a risk adjusted basis, the large cap Nifty 50 index scored better. Ofcourse, there were periods of outperformance, but very clearly the range was limited and the commensurate risk-reward was unfavorable.

Management depth

Large cap companies are run by professional teams, overseen by eminent board members, only because they can afford to do so. Since leadership position has already been achieved, these companies place significant emphasis on reputation, brand and corporate governance. Institutional investors insist on global standards of reporting and investor transparency, which is readily available in most of such large caps. On the other hand, mid and small cap companies face two major issues; retaining the best talent and succession in their management (which in many cases are family run businesses with a few key people). This is a Black Swan event that smaller companies face and mostly ignore.

Well researched

Large caps have regular interaction with the investment community and are rewarded for their transparency by drawing more institutional long-term investor interest. They are well-researched as they provide authentic and timely data. Life is easy for the layman to choose amongst the large cap universe. The same is not true in the case of smaller companies, which resist sharing information and prefer to remain opaque. Hence, investors are led to make larger number of assumptions based on vague data and their analysis remain ambiguous.

Liquidity

Another inherent advantages of investing in large cap stocks is liquidity. Significant volumes are traded daily by individuals, domestic and foreign institutions. Hence the cost of transacting in such large caps are low and the price efficiency remains high. On the other hand, there is a liquidity premium when transactions take place in illiquid small cap stocks that adds to the cost. There is also a limit to buy these small caps owing to their lesser size. The situation is exacerbated especially during sell-off’s when panic hits the street. Under such cases the draw-downs for low market cap companies are significantly higher.

Large caps are certainly not duds or underperformers, but essential for creating wealth. They might not hold enough excitement or warrant story telling as in the case of a small cap investment. But clearly, the risks involved are lower and commensurate returns much higher.

Remember…David required divine intervention in order to succeed, so if you are a small cap investor better start praying!