One of our recent studies entailed calculating the rolling returns for Nifty 50 over several time periods. It took into account each day the index traded since 1994 (6152 days). The outcome of the study indicated the following: Investment at market peaks took as long as 10 years to turn profitable (the worst-case scenario) and investments made at lower levels took much lesser time. Basically, it quantified and re-iterated the fact that time required to make profit depends on the date/level you had invested. So, what’s the big deal, I knew that long before you were even born!!@#$

While we all know this for fact, it is seldom applied in practice. It is clear; there is only one way to make money in the market “Buy low and Sell high”. To know what is High and Low requires a good understanding of Market Cycles. Here, we attempt to elucidate this briefly-

Why study market cycles?

Evaluating the current stage in the market’s cycle allow us to envisage what will happen next with a fair degree of accuracy. This is a significant piece of information. This knowledge can prove to be paramount especially when the market is at its extremes. Simply by avoiding investing at market tops and buying lower can reduce your investment life cycle and enhance your risk adjusted returns quite significantly.

Who uses market cycles?

Rational investors; a minority, are unemotional, risk averse and skeptical but are always prepared when opportunities with returns that more than compromise the risk taken. Markets are filled with constant noise under the pretext of guidance. It is key to figure which are the ones worth hearing, make logical inferences based on those important ones and conclude on how to characterize the current investment scenario. The superior investor understands this well, it is this quality that will allow them to make superlative investments at the right stage of market cycles while being exposed to the most reasonable risk. They study market cycles to structure their portfolio optimally for the likely events that may lie ahead, understanding that they may not always be right, but will be right most of the times.

Human psychology and behavior play a big part in creating cycles, hence successive cycles are not identical. Intrinsic tendencies to exaggerate beliefs provide stimulus to the market’s animal instincts that may cause it to rally in any direction. Understanding market cycles allows us to calibrate our investment strategies to be aggressive or defensive. Investor attitudes are conflicted between greed and fear for profits, optimism or pessimism about the markets, tolerance or aversion of risk on investments, acceptance or skepticism of market information, believing in future value or looking for acceptable value in the present and finally, urgency to invest or panic to liquidate holdings.

When does a cycle start and end?

Although there will be shifts in time periods and the intensity of the swings this is the pattern the market exhibits and more importantly each stage is caused by the previous one implying, they are all interconnected. The market cycle is a continuum and does not have a beginning or ending point. Recognizing this causal relationship between several cycles is hugely beneficial in developing strategies.

How to analyse market cycles?

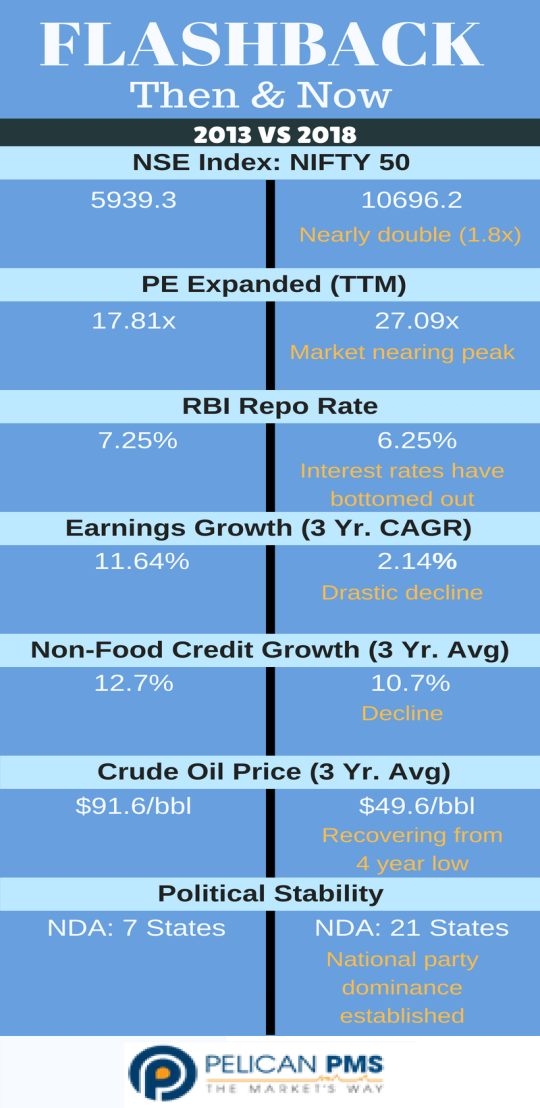

In order to determine the stage of the market cycle we require two forms of evaluation namely, quantitative and qualitative. Quantitative evaluation involves gauging valuations by inspecting fundamentals with relevance to historical points. Significant variation from valuations in normal periods is an indicator that the cycle is to drift from the underlying central trend. Qualitative evaluation firstly involves understanding how things are priced, which is determined by the supply demand equilibrium and willingness to pay. Willingness is influenced by how buyers value investments currently and what they feel about its potential to appreciate. This relationship dictates circulating prices that are paid for investments in any sector. Secondly, we need to understand how investors are conducting themselves with respect to pursuing returns, skepticism towards information and market valuations and urgency upon which they are engaged in buying and selling. Consistently performing these evaluations will enable us to understand where we are positioned in the market cycle.

It is imperative to realize that even the best economic conditions cannot help us predict what will happen next. Meaning it is possible that the market may move upwards, downwards or be stable from any point; but that does not imply that each of those have the same likelihood.. Apart from already developed investment methods that involve analyzing fundamentals and pricing; studying the prevalent investment environment and gauging risk tendencies of market participants will provide crucial inputs that aid in decision making.

End of Gyan…

We have managed to crack most of the puzzles, turned several dreams into reality and evolved positively over the past centuries. Our lives are much easier now when it comes to travel, communication, food, accommodation, education, etc. However, despite all this we remain in status quo with regards to Stock market investing. We haven’t improved the way we invest; the same mistakes continue generation after generation. This is primarily due to the ignorance towards our understanding of market cycles and incompetence in personally analyzing investments while easily being influenced by market noise. Watching market prices on a daily basis is a fruitless exercise, rather spending time on planning the investment and patiently waiting for the right opportunity will reduce risk, enhance returns and lower your blood pressure.