I was given the great opportunity one day of selecting the next binge series for my kids. They seemed to have watched almost everything available on TV over the last couple of months and were out of ideas, hungry for more. For those of you who don’t touch the remote (like yours truly), this is an arduous task. With the millions of videos available it’s hard to know where to start. With great power (of the remote) comes great responsibility. The father in me decided to go for quality sans cartoons, something that will instill knowledge and improve vocabulary, something they can cherish for years and time spent productively…(so much bragging!). Ten minutes of browsing took me to Lemony Snicket’s “A Series of Unfortunate Events“. It sounded like the perfect title for the occasion.

I was given the great opportunity one day of selecting the next binge series for my kids. They seemed to have watched almost everything available on TV over the last couple of months and were out of ideas, hungry for more. For those of you who don’t touch the remote (like yours truly), this is an arduous task. With the millions of videos available it’s hard to know where to start. With great power (of the remote) comes great responsibility. The father in me decided to go for quality sans cartoons, something that will instill knowledge and improve vocabulary, something they can cherish for years and time spent productively…(so much bragging!). Ten minutes of browsing took me to Lemony Snicket’s “A Series of Unfortunate Events“. It sounded like the perfect title for the occasion.

The storyline is worth mention, three little kids encounter one problem after another constantly brought about by the treacherous villain. The whole series is shot in a very gloomy background, constant playing of melancholic music, and weird looking characters. Quite often the depressing scenario and dark comedy makes us miss the brilliant attempts pursued by the children and their successful maneuvering of misfortunes against all odds.

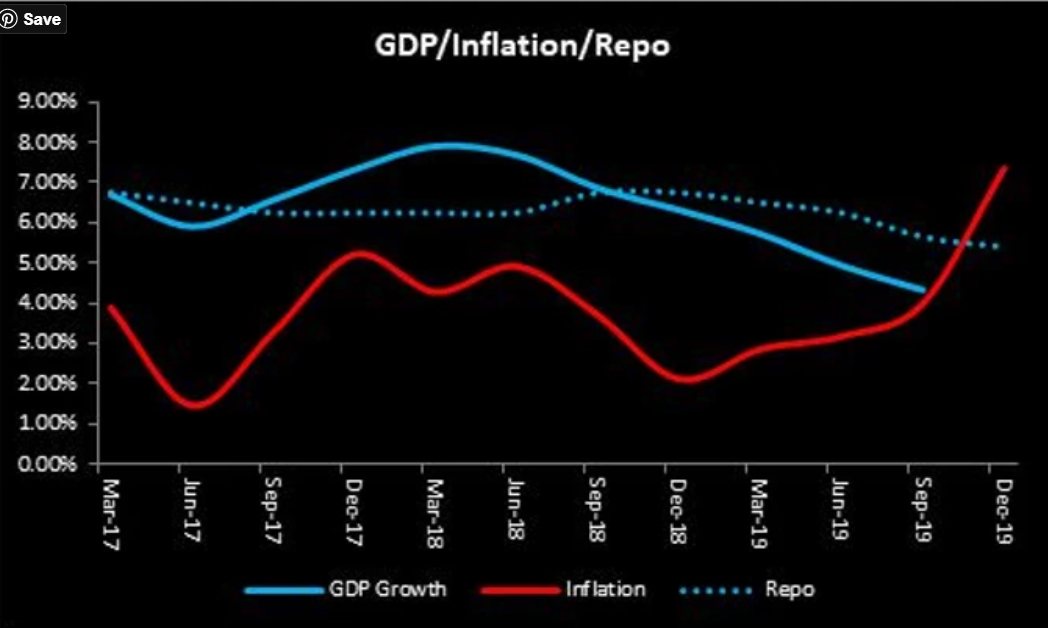

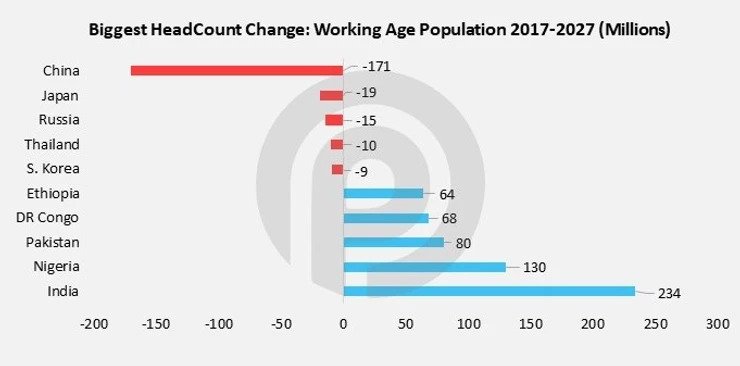

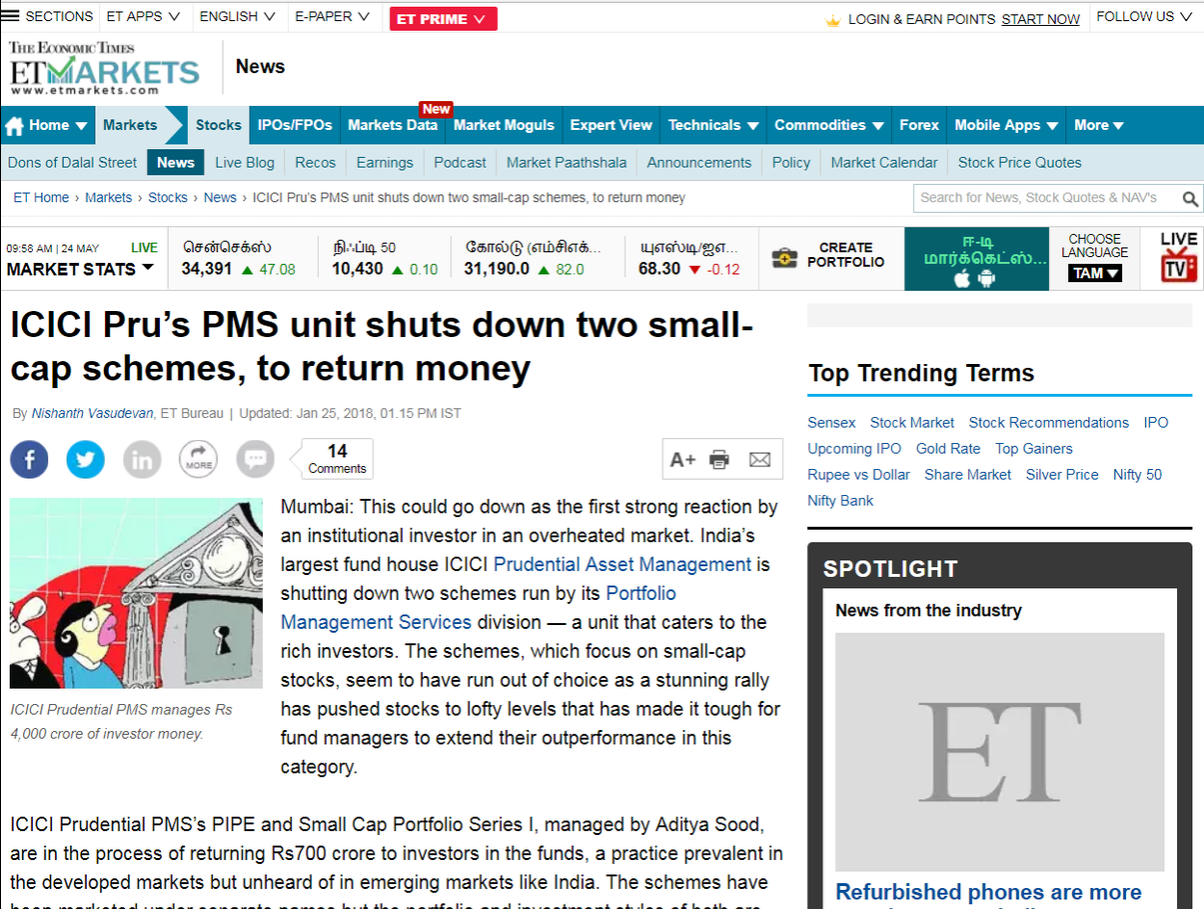

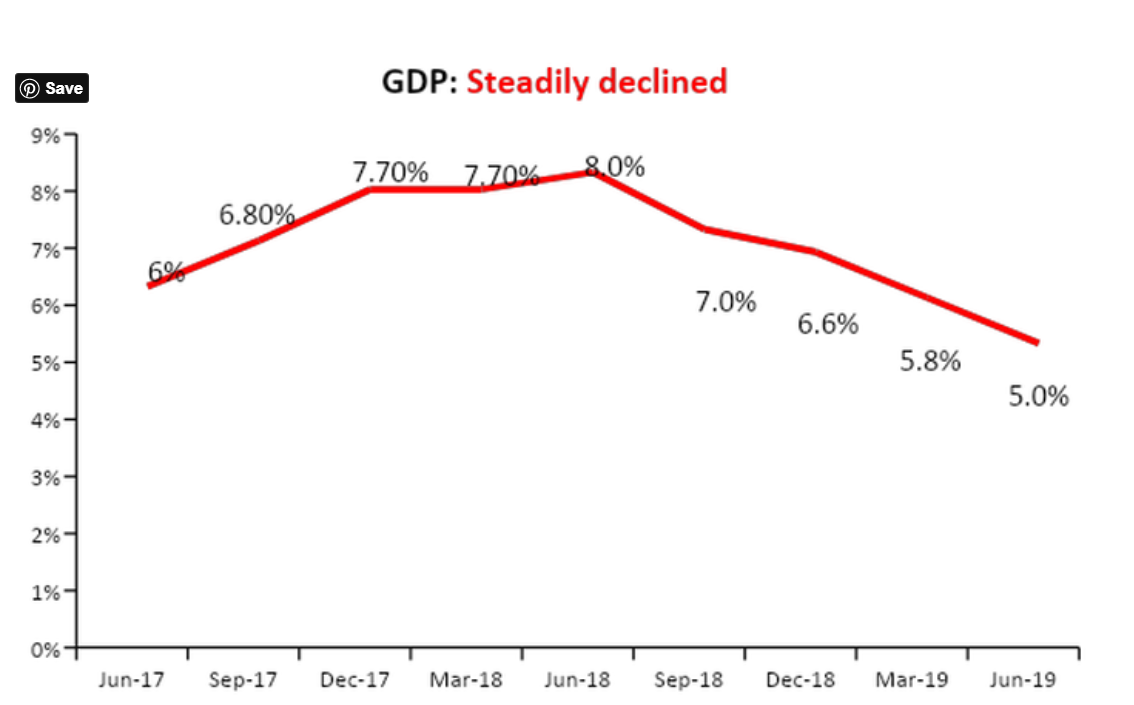

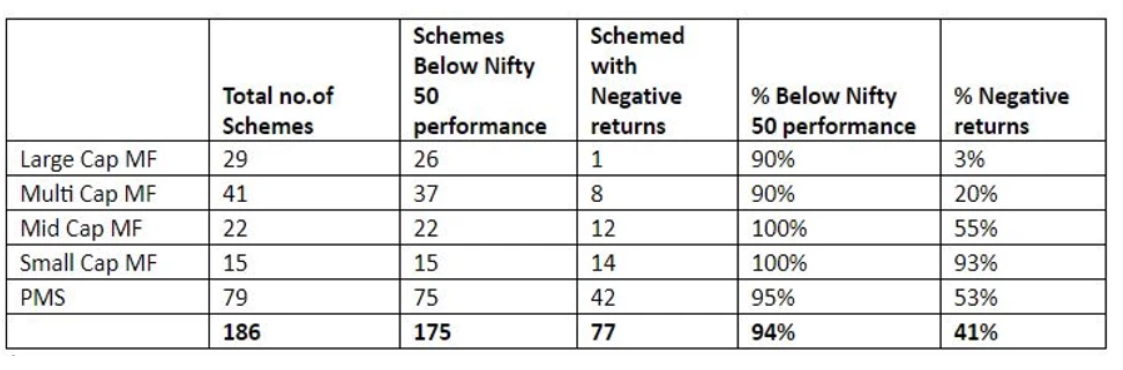

This draws parallel to the scenario investors have been facing over the last couple of years. They got their first shock in Jan 2018, when Nirav Modi and team eloped with about $2bn, soon followed by and even bigger ILFS scam. Several corporate governance issues cropped up especially in the mid-small cap space, auditors exited one after another citing unexplained transactions. Liquidity dried in the bond markets and rating agencies went into a state of quandary. However thanks to foreign fund flows and great marketing strategies by local MFs, money continued to pour into select stocks which took the indices to all time high levels. While the markets conquered one peak after another, the quarterly GDP growth halved, auto numbers dragged, core industry growth fell into the negative, credit growth slowed. Indiabulls, Yes Bank, Karvy were some big names that fell from glory. Those who sold early lost out on the upside while those who bought got into the wrong stocks that never moved. To top it all, this year witnessed the all en-compassing pandemic. Unfortunate events, one after another!

We have become so engulfed in gloom these days. We wake up only to read about the never ending covid numbers, sad stories are shared by neighbors, no travel, no office, no pizza, no booze, dreadful emi’s, scare of jobloss, all this while you wait for your turn to be quarantined. Worst of all, the Nifty moves up everyday and your portfolio moves down by the same amount (dark comedy!)

Adversity should automatically bring out the survivor in you, if it doesn’t you are dead! But sorry, this is not going to be a motivational blog nor am I another health expert to discuss a solution to corona. My efforts are strictly directed only towards your portfolio and how to manage the same under the current situation. How do we play the market now, what strategy will work and is timing even possible.

Firstly, this is certainly not the time to pick stocks and draw excel road maps, because nobody in the world can envisage the business model two years down the line. The conventional method of stock picking from the mid-small cap space can at the least be considered as wishful thinking. Yes, several business will certainly close down forever, but there will also be those that will take up the market share from the ones who lost it. Large companies with long history, distinguished track record of management, robust balance sheet, low debt and minimal exposure to exports will be the best bets and most probable survivors. Re-balance your portfolio towards such stocks, irrespective of the profit or loss you currently incur. Remember there will always be value for quality.

Secondly, nobody is sure at the moment about how far the recession would go, hence no use of timing the market or guessing the bottom. Rather look for index PE levels and invest in phases across these levels as they move lower. We can only operate within a framework of our historical understanding of these levels and under the basic premise that all will be well someday, a cure would be found and the country will go back to glory. So keep adequate cash to average out your positions and don’t dump it all in one go.

Finally, sitting at home might tempt you to indulge in lot of TV viewing, unnecessary reading and frequent chatting with friends. There is likely to be an information overload in an already chaotic environment. The following are the suggestive techniques to overcome this problem

a. Have a rudimentary process to invest and stick to it. Complicating has never solved anything. But make sure to follow the process religiously. (Scientists have proven that…this reduces distraction levels to a bare minimum!) You will start focusing only on what you actually want.

b. It is true that risk is reduced by diversification, but that doesn’t mean we need 100 stocks in our portfolio. Meaningful diversification can happen through 10 stocks as well. Select sectors that you understand well, have tangible business and decent corporate governance.

c. Success of most investors is only due to their temperament. Hold this one tight at all times no matter what you lose.

So the story ended on a happy note with the children converting every misfortune into success and the villain vanquished. There is not a scene where they lose hope and do not look for innovative ways to stay afloat. But then I asked my kids, why they did not chose this beautiful series when they had scanned the globe…they said it was the title “unfortunate events”. Well then I thought, it is so true that nobody wants to be associated with misfortune, but we always travel with it. Isn’t it best to be prepared and turn it into an opportunity when it strikes instead of sulking over it?

That was the learning for the family. Time well spent indeed.

Deepak Radhakrishnan

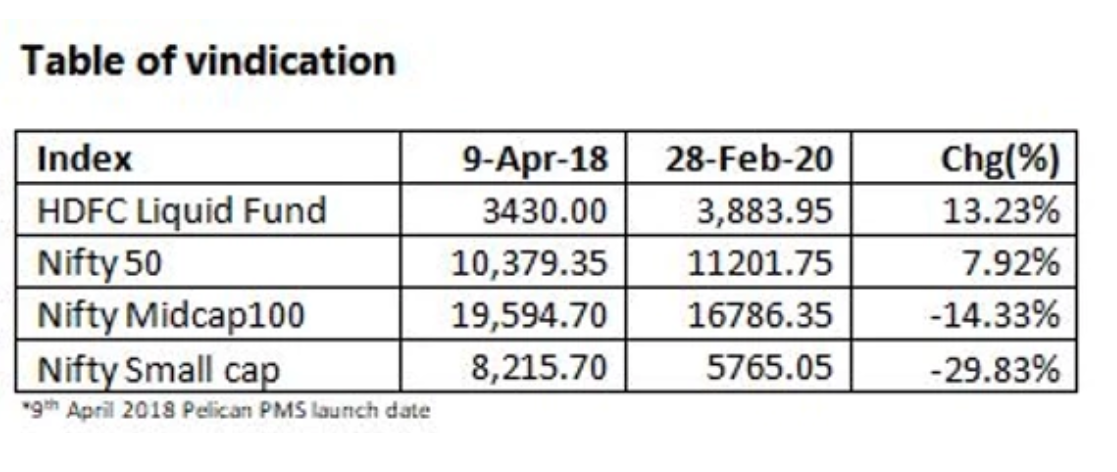

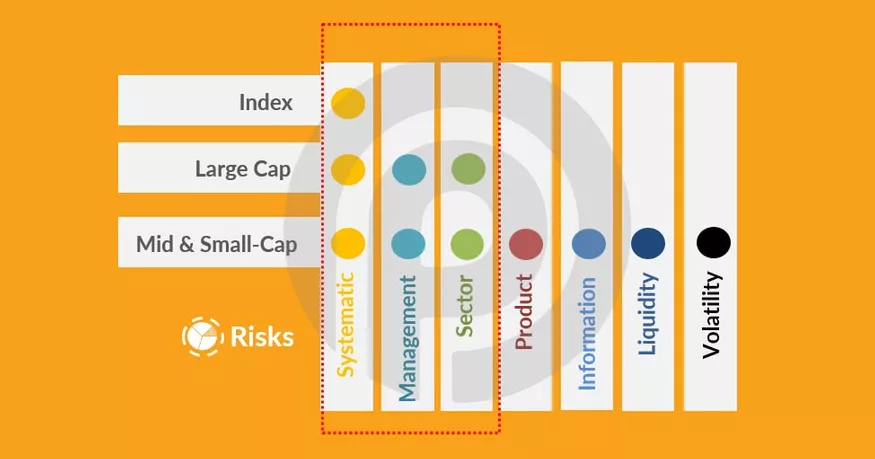

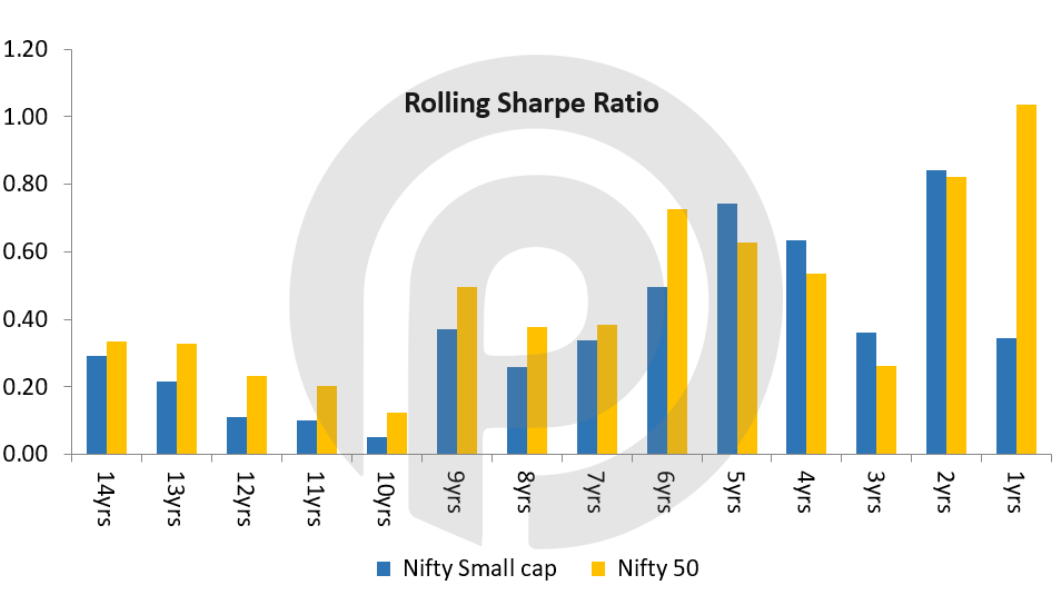

In order to assess the fundamentals and arrive at profit estimates in a reasonably accurate manner, the company under review should have evidenced a successful track record over several economic cycles. Management record must be clear and free from any regulatory action. Investor relations and information flow from the company should be transparent and timely.The product/services should have significant comparative advantages. There should be a proven wherewithal to survive any downturn and comeback stronger. Finally, liquidity is of utmost importance especially during bear markets. All of these points can only be addressed if the company has a long history and belongs to the large caps.I like the gyan… but what about the returns? Aren’t Large caps generally duds!

In order to assess the fundamentals and arrive at profit estimates in a reasonably accurate manner, the company under review should have evidenced a successful track record over several economic cycles. Management record must be clear and free from any regulatory action. Investor relations and information flow from the company should be transparent and timely.The product/services should have significant comparative advantages. There should be a proven wherewithal to survive any downturn and comeback stronger. Finally, liquidity is of utmost importance especially during bear markets. All of these points can only be addressed if the company has a long history and belongs to the large caps.I like the gyan… but what about the returns? Aren’t Large caps generally duds!

We are at an intercept. Don’t get nervous about what’s happening around simply balance and re-balance between savings and investing. Sometimes it is sensible to become an ostrich, do nothing and just stay insulated from the environment around you …atleast you will be rewarded with the biggest egg!

We are at an intercept. Don’t get nervous about what’s happening around simply balance and re-balance between savings and investing. Sometimes it is sensible to become an ostrich, do nothing and just stay insulated from the environment around you …atleast you will be rewarded with the biggest egg!