Starting early in 2000s the IT revolution bolstered India’s job market; especially for the deprived middle class. It also gave way to several varieties of jobs and innumerable travel opportunities, thereby increasing the investable surplus of this generation of workers. A generation with multiple sources of income and more than one earning member in a family is becoming common. This was something the previous generation couldn’t have imagined in their wildest dreams. As an outcome of the prosperity of the middle class; there has been gradual but definite changes, especially in the attitude of the current generation of investors. The Millennials differ significantly from their predecessors. Their awareness, accessibility and comfort in taking risks, perspectives about life and investing methods are evidently different.

We list down 5 dramatic and difficult to reverse first time changes that took place over the last couple of decades. This forms the basic premise of our positive view on Indian equities-

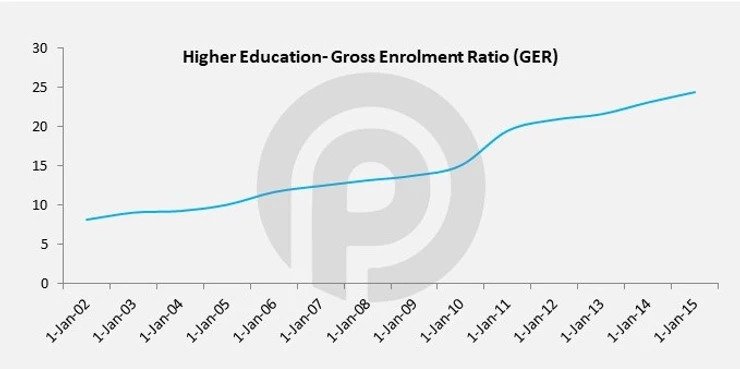

- Stupendous rise in higher education levels:

India has never in the past witnessed such an exponential increase in college enrolments as seen in the last two decades. Erstwhile investors stuck to physical assets primarily due to ignorance. Education has helped change this scenario and improve confidence and knowledge in the current generation of investors. We believe this trend is only going to get better as the affordability and importance of education drives into the system. This shift is tectonic and tops the list of changes that took place in this millennia.

Source: Central Statistics Office, India

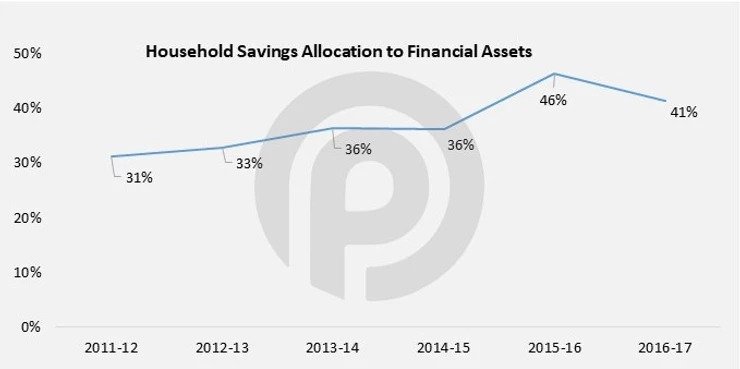

2.Shift towards financial assets:

Evidently, there is an increasing aversion towards illiquid physical assets that are sticky and difficult to manage vs. an increasing preference for liquid Financial assets. This has come across due to financial product innovation. Innumerable schemes, that are transparent, cheap, flexible and suit every need of the investor have flooded the market. To put things in perspective there are 43 Asset Management companies, 215 PMS entities and 57 Insurance companies managing investor money across various structures. The convenience and suitability of financial products will be a major driver for the change in asset allocation of household savings of the current and future investors.

Source: Central Statistics Office, India

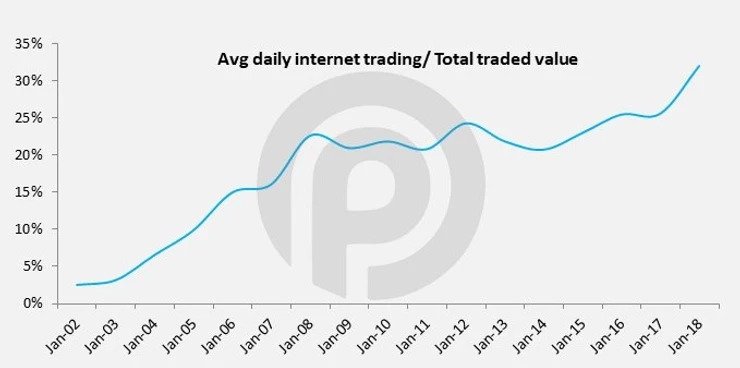

3. Technology has removed boundaries:

As technological advancement improve at a staggering rate- financial data, trading, settlement and advice have become more accessible and transparent than ever before. Internet has created a revolution in the way things work in the stock market. Conventional brick and mortar model is soon vanishing and geography is no impediment to investing. This has opened a whole new realm of opportunities and investors from remote areas are now active participants in the Indian stock market. More than Rs.10,000cr are traded in the capital market segment on a daily basis via internet (from a meagre 5% in 2002 to over 30% of the entire value traded is via internet trading). The advent of technology in the early 2000s is again another first in the history of the stock market and certainly here to stay.

Source: www.nseindia.com

4. Size matters:

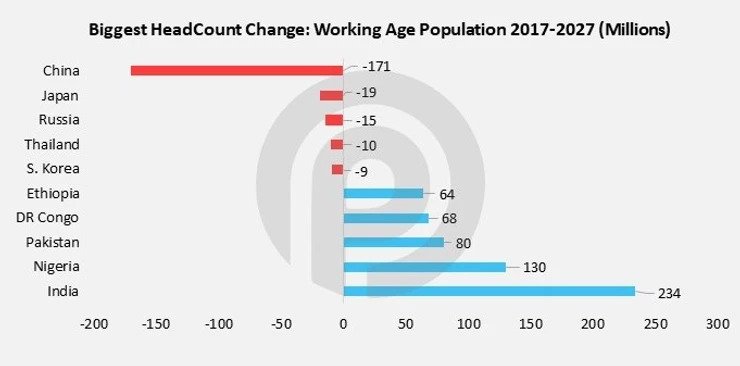

India is the 6th largest economy in terms of GDP (@ $2.8tn, nominal) and belongs to the elite group of countries that have surpassed the $2tn mark. It is estimated to reach the 3rd position in a decade. No other country in the world is of this size and growing at such a rapid pace. The size of the country and the opportunity it brings cannot be ignored. By 2020, the average Indian will be 29 years old compared to 37 for China and 48 for Japan. With 65% of the population below 35 yrs, it is imperative that the demand for infrastructure, education, services etc. will increase irrespective of the government that comes to power. The necessity to service this increasing need of the young population will keep the demand scenario buoyant. While on one side Foreign investors are lining up to service this demand, on the other side large Indian corporates that have traditionally been B2B have shifted focus to create products and services that cater to the retail crowd (B2C). India will reap the benefit of this demographic dividend in the decades to come.

Source: UN World Population Prospects 2017

5. Regulators are working overtime:

Regulatory improvements have been part of the evolution process. The increasing investments from foreign players as well as significant local institutional participation has forced regulators to formulate policies that adhere to international standards. Corporate communication and information flow have taken a leap over the past decade providing the much-needed security in equity investing. Timely reporting of results, conference calls, investor relations are mandatory requirements now. Further, the process of reporting complaints and follow-up mechanism is much easier and effective. Lastly the numerous nosy media channels that have cropped up give little room for mischief. The Indian stock market has grown to become the 8th largest in the world in terms of market capitalisation. It has certainly matured over the past couple of decades on the back of robust process and transparent mechanisms that are worthy of emulation. This irreversible change brings great promise to Investors and they certainly feel much safer now than they did twenty years ago.

India has passed through several phases since its independence, and we believe it is currently in a sweet spot. The learning’s from the past have certainly prepared the country for the future. With solid underlying strength and improving metrics, equity participants will be the biggest beneficiaries in the times to come.

So guys, hold on and stay invested!