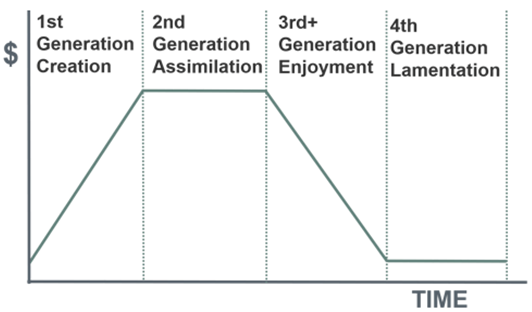

The all-encompassing want is money. Human love for money is never ending, some manage to get more than others either through force, knowledge, inheritance, talent, or luck. However, it is a myth that the rich know what to do with money. It is also a myth that the intelligent ones are financially savvy. How many rich parents have richer children, historical studies indicate that the graph start to slide from the 3rd generation onwards.

Source: https://www.genlegco.com/wealth-advisors-family-planning-consulting-services

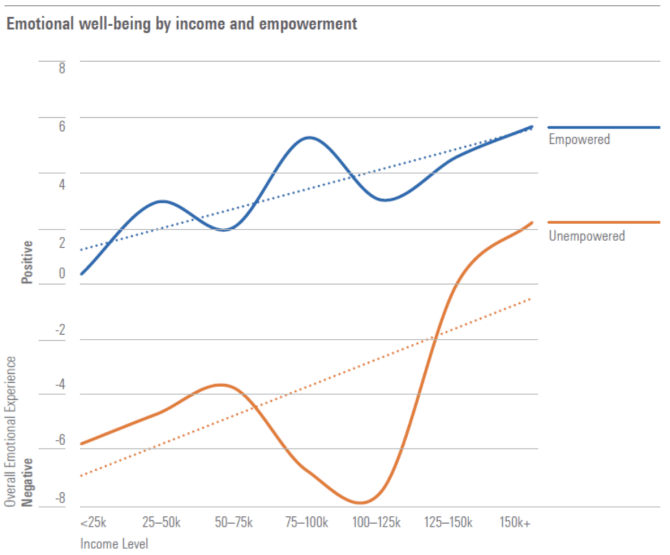

The graph below is a typical representation of how emotional wellbeing and income levels are related. There is only one thing that connects the two and that certainly is not the amount of money one has; it has more to do with EMPOWERMENT

https://www.morningstar.com/insights/2020/02/13/financial-empowerment

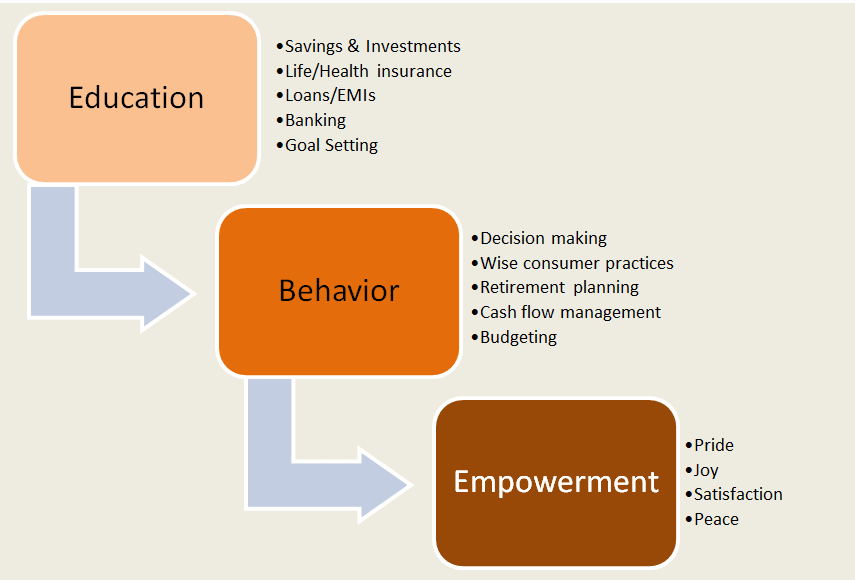

Empowerment is the process of improving the capacity of people to take decisions that are appropriate to achieve their financial goals. Empowerment starts with financial education/literacy. Whatever be your profession or your income levels, your understanding of finance is essential for your security. Understanding finance does not mean being an expert in accounting, reading balance sheets or keeping track of financial jargon. Rather, it is the awareness towards what you earn, how you earn and how you spend the same. What remains after spending becomes your savings, the seed for your wealth creation. Cognizance of your personal finances and clarity on your goals enable changes in behavior. Behavior affects your mental state, and if you are really empowered then there is a better emotional experience through the feeling of pride, joy, satisfaction, and peace.

“Tell me and I’ll forget; show me and I may remember; involve me and I’ll understand” … Steps to empowerment should include reading, discussing, practicing the skill of money management. There is no substitute for hands on experience to understand the process of savings and investment. A rudimentary process backed by discipline and solid temperament is more than sufficient to ride the cycle of boom and bust. Progressive experience will enhance the returns improve the process and relieve the investor from the surrounding cacophony.

There is significant evidence that indicates that a higher percentage of woman have lower levels of financial participation. The potential implications of gender differences in financial literacy and participation within the household reduce women’s active participation within the economy; economic power within the household; transmission of knowledge to the next generation and lead to worsening existing social disparities. As we progress towards a world where individual financial decision-making is imperative, women may be disproportionately vulnerable. Empowering women financially will greatly reduce a root cause underlying gender differences.

Financial inclusivity propels growth of a country. Being financially empowered helps understand the products in our globalized marketplace, choose wisely and participate. Financial empowerment helps an individual make a more assertive, confident, and efficient decision. In essence it helps people in framing proper responses to situations involving risk and opportunities. This is when money starts working for you.