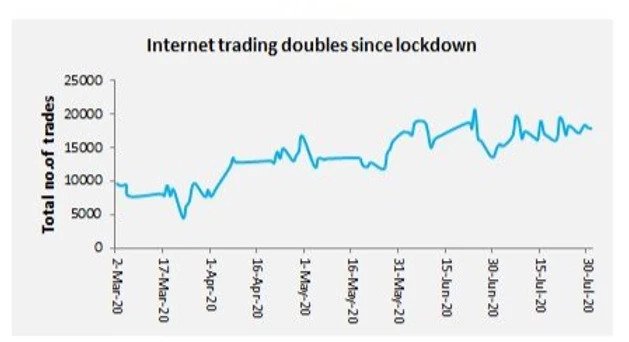

This pandemic has introduced several peculiar situations into our lives. With no movies, shopping, gyms or offices we have been forced to look for new sources of entertainment. While a few have pursued meaningful activities like reading, yoga, music, art and webinaring a majority have found a new love – The stock markets. There has been a flood of new broking/demat accounts opened since the lockdown in March this year. It appears to be the new fad in town and every neighbor has one. Several first time investors who till recently were on the sidelines due to paucity of time have managed to dabble in the markets for 5 hours in a day. Aggressive brokers have seen frantic account opening activity and doubling of their client base over the period. Supportive regulatory changes such as online KYC have helped ease the process. Technology backed settlement and internet trading has come a long way, making execution significantly easy and child’s play.

This pandemic has introduced several peculiar situations into our lives. With no movies, shopping, gyms or offices we have been forced to look for new sources of entertainment. While a few have pursued meaningful activities like reading, yoga, music, art and webinaring a majority have found a new love – The stock markets. There has been a flood of new broking/demat accounts opened since the lockdown in March this year. It appears to be the new fad in town and every neighbor has one. Several first time investors who till recently were on the sidelines due to paucity of time have managed to dabble in the markets for 5 hours in a day. Aggressive brokers have seen frantic account opening activity and doubling of their client base over the period. Supportive regulatory changes such as online KYC have helped ease the process. Technology backed settlement and internet trading has come a long way, making execution significantly easy and child’s play.

The stock market is a great enticer especially because it involves money. Considering that many have faced a reduction in their salary or job loss, a second source of income does come handy. The moratorium package has helped postpone a few months of EMIs, this savings also may have found its way into trading. Another segment that has been a big participant is the small and medium entrepreneurs and realtors. They are unable to deploy funds into their business and the same may have been diverted into the stock market. RBI has been following a benign policy of keeping rates low to improve the risk appetite. Deposit rates have shrunk to a paltry 4%. With nowhere else to go for a decent inflation adjusted return they may feel equities are the only route. There are hordes of advisers waiting for such an opportunity and have been the biggest beneficiary of this sudden spurt of interest. Their influence adds to the frenzy. All the segments mentioned above have started relying on the stock markets for their near-term investment goals, and their investment process is generally defined as speculative trading.

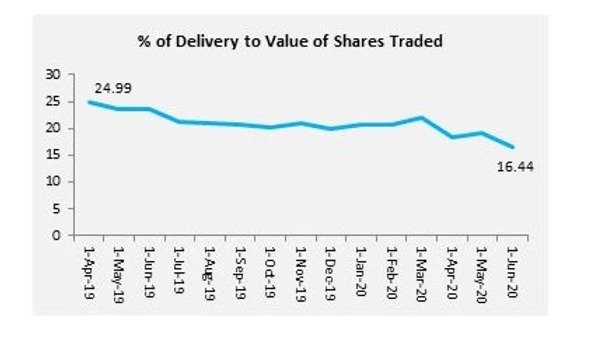

Chart 2: Rise in speculation as indicated in lower delivery trades

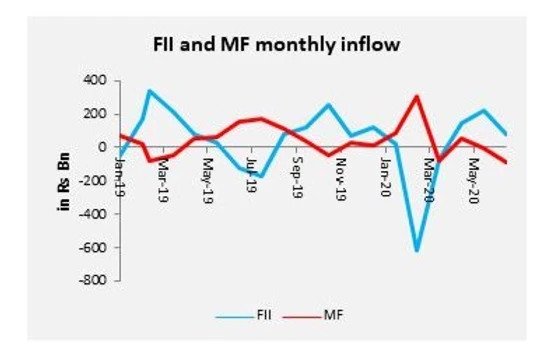

What about the big boys who primarily comprise the Mutual Funds and FIIs. Data clearly suggest many FIIs have been sellers for a long time and their exposure to emerging market investments have reduced significantly. As for the Mutual funds, the last two months have seen a decline in fund inflows and SIP stoppages. What this suggest is majority of the volume (estimated 85%) may be contributed only by the aggressive retail community.

Chart 3: Chart on MF/FII inflow

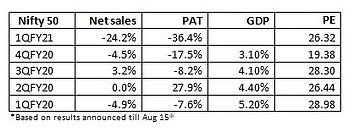

Valuations are determined by two factors – sentiments and reality, the former most of the time overshadow the latter. Sentiments is quantified in the price while earnings determine the reality. While it is evident that the crowding-in of retail activity is the main reason for the increase in price movement, what then is the underlying reality-