The Indian stock market has nearly 5000 listed companies. During times of market frenzy there is usually a spurge of stock recommendations by fund managers, brokers, neighbors, chai-walas and others. We see almost 4999 companies in the recommendation list. How many can you buy? One such friend had nearly 120 stocks in his portfolio each bought for a value of Rs.1000. His rationale was simple de-risking of the portfolio by diversification. Do you really need to diversify so much to generate your desired investment return? How do the “professionals” manage money? Is the overly used metaphor “don’t put all eggs in one basket” apply well in investments as well?

Post the stock market crash of 1929, there was an urgent need to formalize the process of managing money. Several prominent scholars started creating theories on portfolio management. One such person who lost nearly all his money got special attention. Benjamin Graham learnt from his mistakes and the losses he suffered that he finally decided to teach his students what not to do and how to become winners (some students did excel!). Diversification is one such theory that was initially promulgated by him to protect the downside. This was later improved and quantified by Harry Markowitz through his Modern Portfolio theory. After nearly 60 years, how have the investors/fund managers evolved and use the concept of diversification as a tool to de-risk their portfolio?

Mutual funds are the easy target. They are the most transparent and provide a lot of historical data for analysis. Hence it is easy to use them for our study. Our study was simple, we took 7 large cap funds (not naming any here..) and broke up their risk and return over a 16year period (2004-2020), then correlated it with the number of stocks they held. We then compared it to a simple portfolio of 10 large cap stocks.

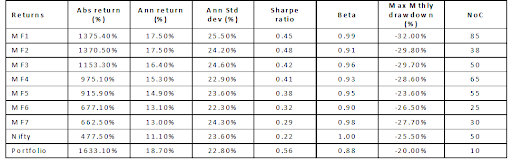

The table below summarizes the results-

*NoC- No.of companies

10 Large caps selected for the exercise were –

Most large cap funds have anywhere between 30-85 stocks. While most of them managed to outperform the benchmark (avg. annualized performance of MFs were 15.4% vs Nifty 11.1%), their volatility as measured by standard deviation was higher (mean annualized std deviation was 23.9% for MFs vs Nifty 23.6%) and so was their drawdown (avg drawdown of MFs was -28.3% vs Nifty -25.5%). Whereas in the case of the portfolio of 10 large caps, returns were the highest (18.7%) and risk the lowest (22.8%). Also drawdowns were significantly lesser (-20%). Which basically evidences the fact that risk did not alleviate with increase in holdings nor did it improve the returns significantly.

This is nothing new that we are stating here, most fund managers are aware of the same. Then why do they expand their portfolio? It could either be their own insecurity regarding their choices, unavailability of quality and sizeable companies to invest or mandatory requirement by the regulator. We believe it as a combination of all of them. Nevertheless, investors are at the receiving end as they do not get the best returns for the risk considered. PMSs do a better job in this regard as they have a much concentrated portfolio and not as much constrained by regulation.

While there is no denial that diversification is a good tool to reduce risk, the portfolio should be built with non correlated business models rather than increasing the number of stocks. There is no magic number and it definitely doesn’t mean more is better. Do not buy all the recommendations that you get, evaluate a few good ones, accumulate and stay with them throughout the cycle. Putting all eggs in one basket is certainly risky; but why should you put only eggs in the basket. Diversify and include items which don’t break like eggs , in that case you are safe!