The Bulls are scared, Bears are terrified, Sheep’s are skinned and Pigs have been butchered…. only the Ostrich has survived…

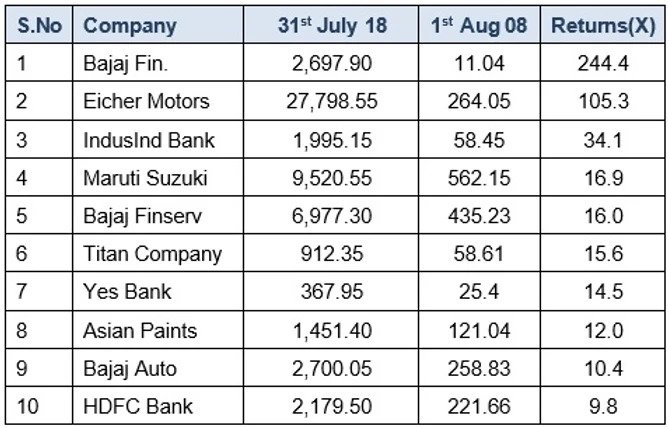

Nifty 50 index surpassed the 10,000 milestone on July 26th 2017. There was euphoria all over the place. Newspapers screamed about the future prospects of the country, analysts upgraded price targets based on the euphoria, economists were gung-ho on GDP growth. Fund flows into AMCs continued unabated with total addition of Rs1.7lac cr into equity MFs and PMSs (Aug 2017-18) taking the total AUM to all-time highs. HDFC AMC took the opportunity and garnered Rs.2800cr via an IPO. The Fear of Missing Out (FOMO) spread like wild fire …nothing seemed possible to stop this monster rally…. investors were ready to make the killing.

So what happened next…

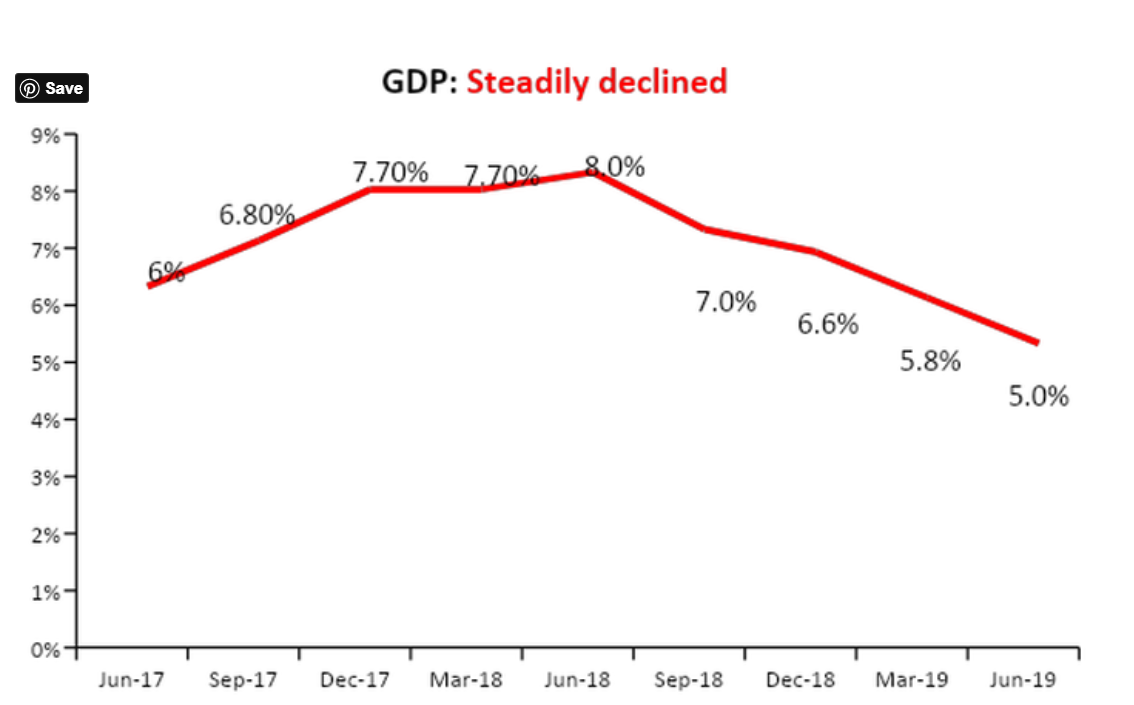

The GDP which rose briefly in 2017 started sinking due to various internal and external factors to reach a low of 5%. Major sectors such as automobile and industrials started facing severe loss of revenue due to slackening demand. Production has been declining by 15-20% yoy and fear of job losses have been increasing. The Banking sector along with NBFC had a double whammy as they amassed huge bad loans and suffered from a liquidity drought. One of the country’s biggest employer the IT industry is also languishing due to redundant business models. Real estate has been the most affected sector post de-monetization and there is also an issue of oversupply in most places. Transaction liquidity has significantly eroded and there are hardly any buyers/sellers in the market. The reasons for a downward re-rating has been apparent for a while, only if we cared to believe them instead of succumbing to media noise and fund manager rhetoric.

Table:1 Returns of active equity investors (Equity MFs + PMS) during the period-

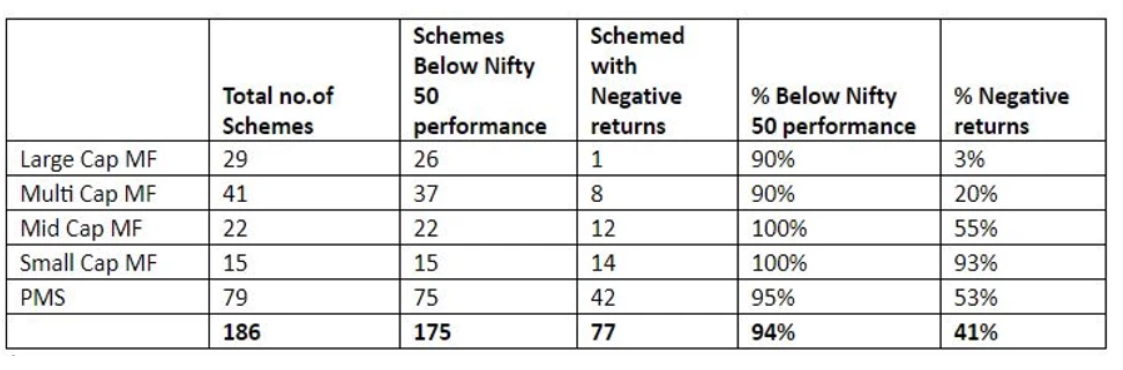

The performance numbers of MFs and PMSs speak a lot about the way investors have been misguided. 94% of the schemes (under coverage) reported returns less than the performance of the Nifty 50 index and 41% of them were in the red. This is underperformance on a huge scale. Period.

Very simply put, when there were no earnings growth for the last five years and when earnings don’t seem to be growing in the near future why would you pay an exorbitant price for investing. Successful investors are those who prudently allocate their assets depending on their understanding of asset cycles. Equities like any other asset class passes through these cycles. Near term equity cycle has peaked out and certainly warrants a good deal of correction. It would be a futile attempt of challenge the numbers that are available and a build a case otherwise.

While there might be little doubt about the potential of India to grow to the $5tn mark, the road ahead is not a bed of roses. Also it is important to understand that the stock market is the only option which offers you liquidity, capital appreciation and a hedge against inflation. The Indian capital market has witnessed noteworthy interest in the recent past on account of stability in the central government, easing of foreign regulations and improvement in business confidence. Indian participation in the global growth is inevitable owing to its size and geo-political stature. For long term investors who are looking to participate in the country’s growth and benefit from capital appreciation, equity investment is the best option.

We are at an intercept. Don’t get nervous about what’s happening around simply balance and re-balance between savings and investing. Sometimes it is sensible to become an ostrich, do nothing and just stay insulated from the environment around you …atleast you will be rewarded with the biggest egg!

We are at an intercept. Don’t get nervous about what’s happening around simply balance and re-balance between savings and investing. Sometimes it is sensible to become an ostrich, do nothing and just stay insulated from the environment around you …atleast you will be rewarded with the biggest egg!

For stock market animal lingo you may check the link below

(https://www.investopedia.com/articles/economics/08/wall-street-lingo.asp)