Patience is not the ability to wait, but how you act while you’re waiting…

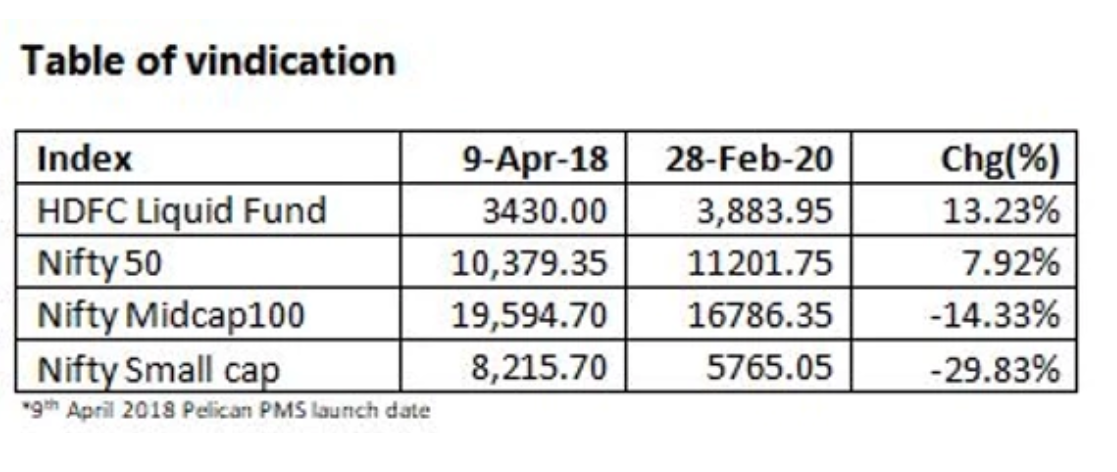

It has been about two years since we launched our PMS. We started the service when the PMS industry was growing consistently @ 15% in terms of AUM growth. FPI was actively investing with Rs.1.2tn coming in that year and domestic MF on their part adding Rs871bn. Interesting themes popped up every day and most fund managers were raking in millions for themselves and their clients. The benchmark indices was breaking new highs, politics continued to be stable, economy was still roaring at +7%, those were the days when ILFS/DHFL/Yes Bank were darlings still rated AA+. But we looked the other way, met potential clients, wrote blogs, invested in liquid funds.

The next year was slightly more boring. GDP started to decline, auto industry dropped to abysmal levels, employment fell to 40 year lows, debt defaults and downgrades became a daily event. Monetary and fiscal policies were made more benign to aid demand growth. Fund managers did not make as much as they did in the previous year, clients started getting jittery, not many new themes were launched. Nevertheless, fund inflows did not stop and benchmark indices took to the skies. We continued to live in boredom, met more clients and wrote more blogs, stayed put with liquid funds.

Over the past couple of years, we have written a lot about of grey rhinos, black swans, white elephants and many other animals which would have set off a trigger driving down the over valuation. But, the markets kept the concentrated rally on, priced beyond perfection. Alas! It was not an animal but a microscopic virus that triggered a sell-off. Enter Covid-19, the dreaded virus that has imprisoned several countries all at once. Never has the world experienced an episode such as this (hope it resolves soon with minimal impact on life and people’s prospects). Within a matter of days, the sentiments changed and the much awaited panic was activated.

At the core of Pelican’s strategy is gauging the systematic risk. We believe systematic risks are larger in magnitude and useful to build the portfolio. The best way to use it is by staying away when the mood of Mr. Market is in euphoria and enter when it is melancholic. Simple metrics such as index PE levels are good indicators of how systematic risk is being priced. They stay low when there is blood on the streets and move higher when in hubris. Systematic risks appearing in a complacent one-way rally often results in capitulation that would. This has happened in the past cycles and could be playing out now!

Pelican PMS has since its launch invested its entire portfolio in Liquid funds and we held our temperament all this while to invest when good companies start trading at attractive valuations. We strongly believe individual stocks are best gauged by cash flow growth and governance standards. This is generally available in large cap stocks, where timely and adequate data is available for an analysis. The chances of ambiguity and use of assumptions are also minimal in this case. A concentrated portfolio of such large cap market leaders will not only diversify risk but enhance returns when the rebound happens. The market prices assimilate all available information at a given time. It is prone to momentum, change in risk appetite and varying liquidity flows based on new information. Hence, buying quality stocks at a marked down price is best done when the overall market is on a sale i.e when systematic risk is in play.

The recent price fall and earnings growth has taken the PE to an appropriate entry level. We believe investors should now start taking exposure to equity and continue investing in a phased manner. The real outcomes in the market will depend on the cash flow impact on business and duration.

Investors should be clear that asset cycles are long, and the returns are undefined. The basic premise that we need to follow is, India is a growing economy and will overcome the current crisis. Equities are the best place to be in order to participate and benefit from this growth. However, it is also imperative that the balancing act be performed suitably.

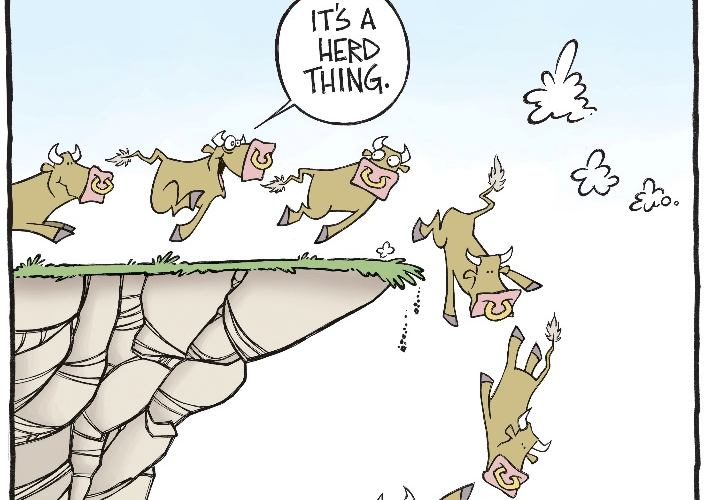

Balancing and re-balancing the portfolio to suit the cycle is the role of a fund manager. While the objective of every fund manager is to beat the market and provide superior risk adjusted returns at a low expense ratio, seldom is the majority successful in their outcome. Beautiful presentations, road shows and media support help garner the AUM to run the business but does not drive returns. Only a minority avoid the herd and think beyond monthly performance.