An often repeated story of a person investing Rs.1000 in an unheard of small cap company called Infosys 25 years ago to end up as a millionaire today…. Good reason to buy into the small caps?! Certainly it is nice to imagine ourselves as that person, and boast about it decades later. But how many of yesterday’s small caps have survived the market onslaught to become Unicorns (I think most of them just evolved into mules/mares/donkeys and joined the herd!). Only sheer luck (most unreliable thing in this world!) can help create wealth in this way. Even the founders of Infosys wouldn’t have envisaged such a stupendous growth, forget the analysts/advisor who claimed to have done that!

Small/Midcaps carry a huge burden of risk, most of which are undefined and cannot be quantified. Without understanding the extent of risk it would be meaningless to enter into any investment opportunity. Then why Mid/Small caps? ….maybe there is seldom a make-believe story that could be created with Largecaps, or it could be the hope of generating the enhanced greeks (alpha, beta, gamma) by undermining the Unknowns or simply just for the sake of excitement. None of them are anyway rationale investment decisions. A sustainable investment strategy should be able to create wealth on a continuous basis. Interim spikes and uncertain earnings mostly attributed to small caps will not serve the purpose. Several small cap funds recently shut shop despite making good profits for their investors as they realized it wouldn’t be prudent to hold on to their portfolios under the current exuberant conditions. It is clear that small caps are seasonal and short term, they gather pace only towards the last leg of the bull rally. When the rally ends, volatility increases tremendously and liquidity completely dries up. Another major issue with regards to small caps is the scalability factor. Serious investors will never be able to invest enough due to the small size, hence even if they manage to double their returns, the absolute profit number will still remain trivial. Our research on Indian Small/Mid cap mutual funds revealed that most portfolios have over 80-100 (some even more) stocks causing undue diversification translating into higher costs and under-performance.

A sustainable investment strategy should be able to create wealth on a continuous basis. Interim spikes and uncertain earnings mostly attributed to small caps will not serve the purpose. Several small cap funds recently shut shop despite making good profits for their investors as they realized it wouldn’t be prudent to hold on to their portfolios under the current exuberant conditions. It is clear that small caps are seasonal and short term, they gather pace only towards the last leg of the bull rally. When the rally ends, volatility increases tremendously and liquidity completely dries up. Another major issue with regards to small caps is the scalability factor. Serious investors will never be able to invest enough due to the small size, hence even if they manage to double their returns, the absolute profit number will still remain trivial. Our research on Indian Small/Mid cap mutual funds revealed that most portfolios have over 80-100 (some even more) stocks causing undue diversification translating into higher costs and under-performance.

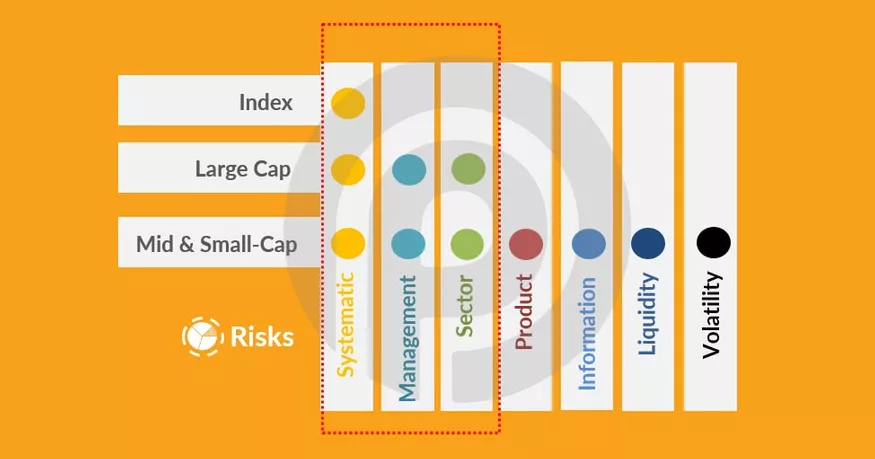

In order to assess the fundamentals and arrive at profit estimates in a reasonably accurate manner, the company under review should have evidenced a successful track record over several economic cycles. Management record must be clear and free from any regulatory action. Investor relations and information flow from the company should be transparent and timely.The product/services should have significant comparative advantages. There should be a proven wherewithal to survive any downturn and comeback stronger. Finally, liquidity is of utmost importance especially during bear markets. All of these points can only be addressed if the company has a long history and belongs to the large caps.I like the gyan… but what about the returns? Aren’t Large caps generally duds!

In order to assess the fundamentals and arrive at profit estimates in a reasonably accurate manner, the company under review should have evidenced a successful track record over several economic cycles. Management record must be clear and free from any regulatory action. Investor relations and information flow from the company should be transparent and timely.The product/services should have significant comparative advantages. There should be a proven wherewithal to survive any downturn and comeback stronger. Finally, liquidity is of utmost importance especially during bear markets. All of these points can only be addressed if the company has a long history and belongs to the large caps.I like the gyan… but what about the returns? Aren’t Large caps generally duds!

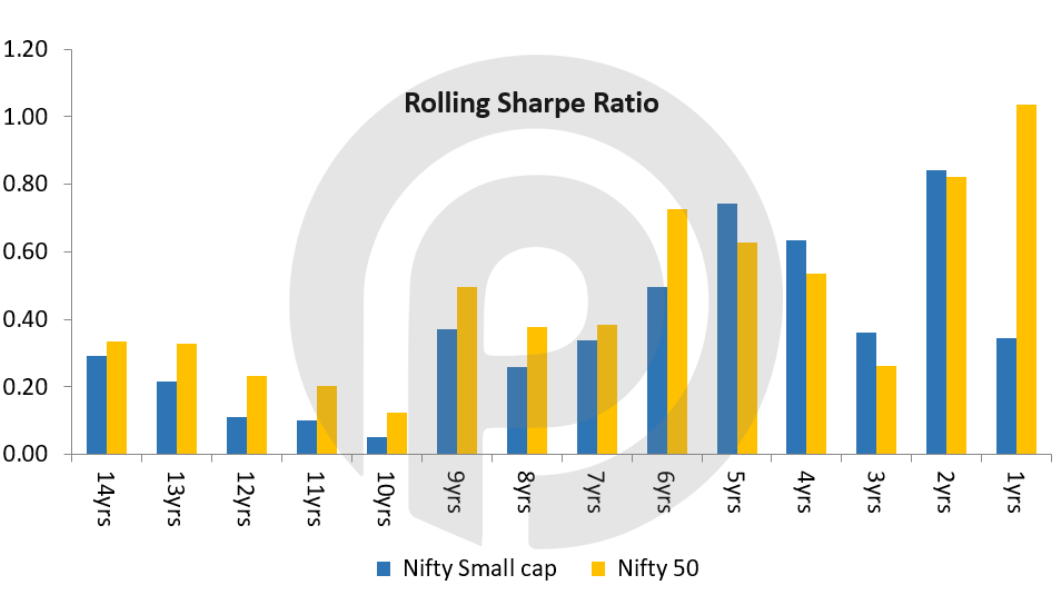

Rolling 14 year risk adjusted performance of Nifty Small cap 100 index vs Nifty 50 index

*Source: www.nseindia.com, Pelican Research

*Data taken from May 2004 to May 2018

*Risk free rate assumed at constant of 5%

Large caps offer real superior returns during both bull as well as bear markets. If one were to start at any of the previous 14 year period and rolled over their investment till date, the risk adjusted performance of the Large cap index (Nifty 50) would have been higher than the Small cap index (Nifty Small cap 100) as indicated by the Sharpe Ratio. While the small caps did outperform briefly during the years 2014/15/16, the trend did not sustain and once again odds favored the Large caps. This is despite the Nifty Small cap 100 outperforming the Nifty 50 by more than 1.5x (in the 14yr period). In other words, the risk ensued is significantly higher in the small cap stocks and does not justify the returns offered. Certainly not for the weak hearts.